capital gains tax increase 2021 uk

CGT is a tax on the profit when you sell an asset that has increased in value. Tue Jul 27 2021 Capital Gains Tax.

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

The 3tn windfall from soaring house prices in the past 20 years should be subject to a capital gains levy so that poorer households can be spared paying more in tax a thinktank.

. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. For those who pay a higher rate of income tax or a trustee or business the rate is currently 28 per. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase.

More likely though if the. That applies to both long- and short-term capital gains. 2021 to 2022 2020 to 2021 2019 to 2020 2018 to 2019.

Basic rate taxpayers would. Hawaiis capital gains tax rate is 725. Or could the tax rate be retroactively applied to the 202122 tax year.

The government could raise an extra 16bn a year if the low tax rates on profits from shares and. Following Uncle Sam and What It Means. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21.

Tue 26 Oct 2021 1157 EDT. This is the amount of profit you can make from an asset this tax year before any tax is payable. Corporation tax In the.

Potential Increase in Tax. Here are the long-term capital gains tax brackets for 2020 and 2021. Entrepreneurs relief was slashed last.

Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four-fold from the 25billion achieved a. Long-Term Capital Gains Taxes. The capital gains tax allowance in 2022-23 is 12300 the same as it was in 2021-22.

First published on Tue 26 Oct 2021 1100 EDT. CAPITAL GAINS TAX is likely to increase and there could be major implications for some Britons an expert has warned ahead of the Chancellor Rishi Sunaks Budget. 12300-Amount on which CGT Charged.

20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property from 6 April 2015. How do we tax capital gains now. Corporation tax and capital gains tax are central to the governments plan to help address the deficit that is on its way to 400bn 559bn this year.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Continued talk of a capital gains tax CGT reform in the UK has been widespread and resounding for some time.

It comes amid ongoing silence from the Treasury around rumoured changes to Capital Gains Tax CGT which had been expected to feature in the Chancellors Spring Budget. First deduct the Capital Gains tax-free allowance from your taxable gain. Add this to your taxable income.

If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers a rise of 25 for a higher and additional rate taxpayers. There is currently a bill that if passed would increase the capital gains tax in. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

Or if you or your spouse made an election in 1994 to increase the ACB of your cottage by using the 100000. Would the rate increase only take place from a future tax year eg. Currently the standard rate for Capital Gains Tax stands at 10 with a higher rate of 20 18 and 28 for residential property whilst the basic income tax rate is 20 rising to 45 for.

You only have to pay capital gains tax on certain assets and do not have to pay it at all if your gains are under your tax free allowance which is 12300 or 6150 for trusts.

Simple Ways To Avoid Capital Gains Tax On Shares The Motley Fool Uk

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Selling Stock How Capital Gains Are Taxed The Motley Fool

Difference Between Income Tax And Capital Gains Tax Difference Between

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

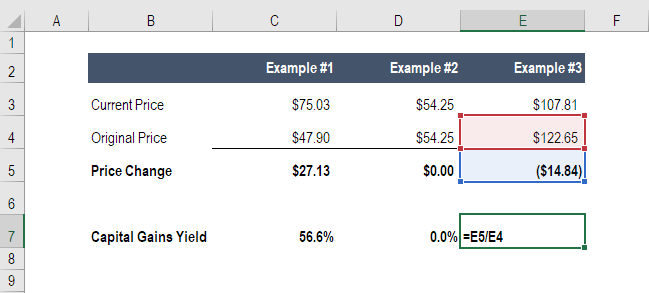

Capital Gains Yield Cgy Formula Calculation Example And Guide

Tax Advantages For Donor Advised Funds Nptrust

The Capital Gains Tax Property 6 Year Rule 1 Simple Rule To Avoid Cgt Duo Tax Quantity Surveyors

Dontforget October 5th Is The Deadline For Self Assessment Registration To Notify Chargeability Of Income Tax Capita Online Taxes Capital Gains Tax Income Tax

Difference Between Income Tax And Capital Gains Tax Difference Between

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Capital Gains Tax What Is It When Do You Pay It

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate

The Capital Gains Tax Property 6 Year Rule 1 Simple Rule To Avoid Cgt Duo Tax Quantity Surveyors

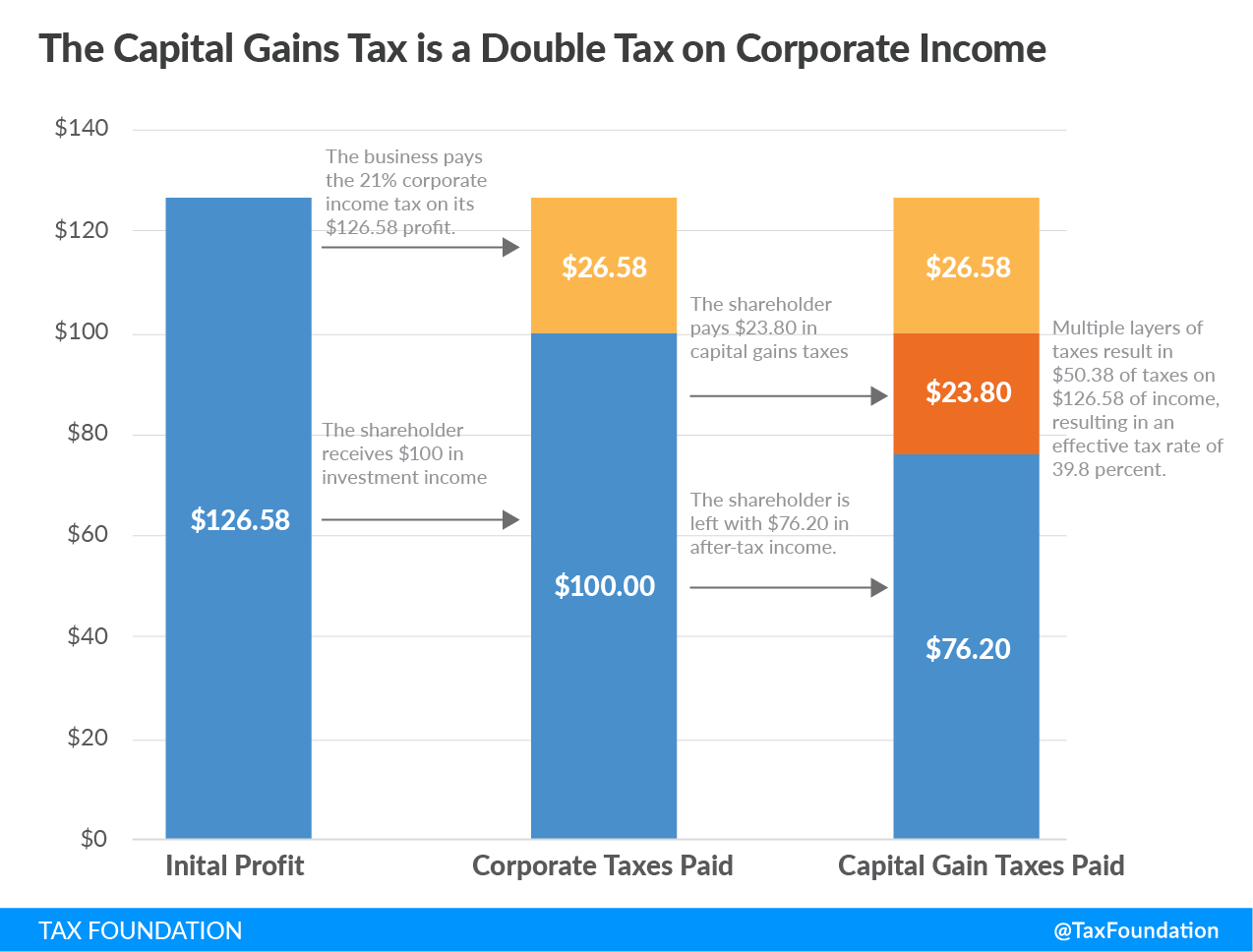

Double Taxation Definition Taxedu Tax Foundation

How To Calculate Capital Gain Tax On Sale Of Land Abc Of Money

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group